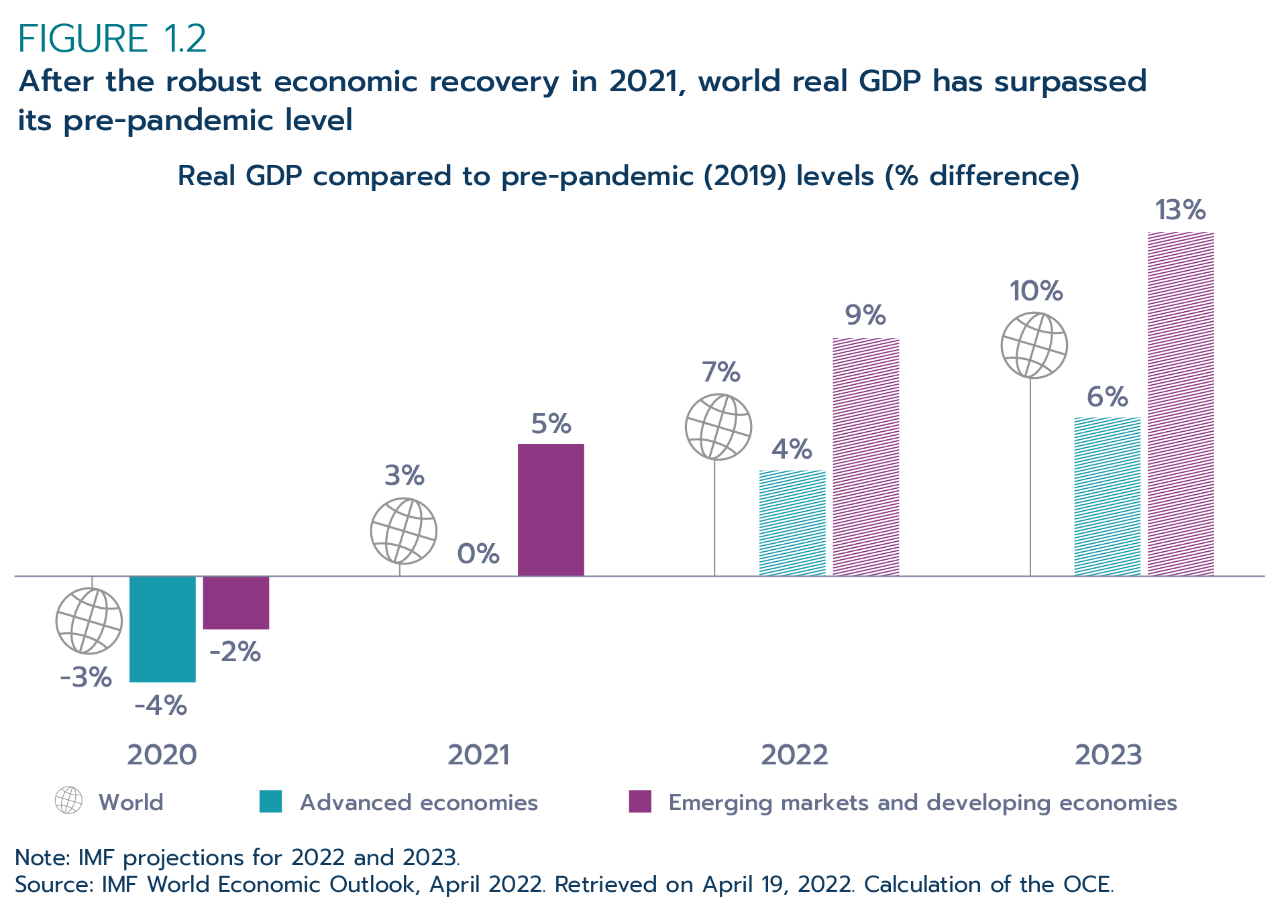

Why won't Canada increase taxes on capital gains of the wealthiest families? FON Commentaries. Vol. 2, No. 20 – Finances of the Nation

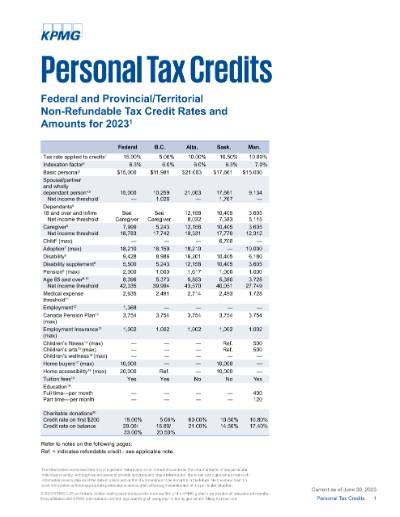

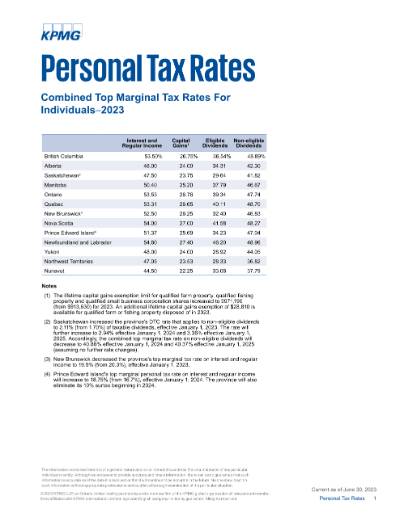

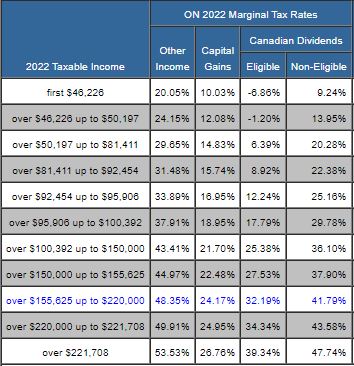

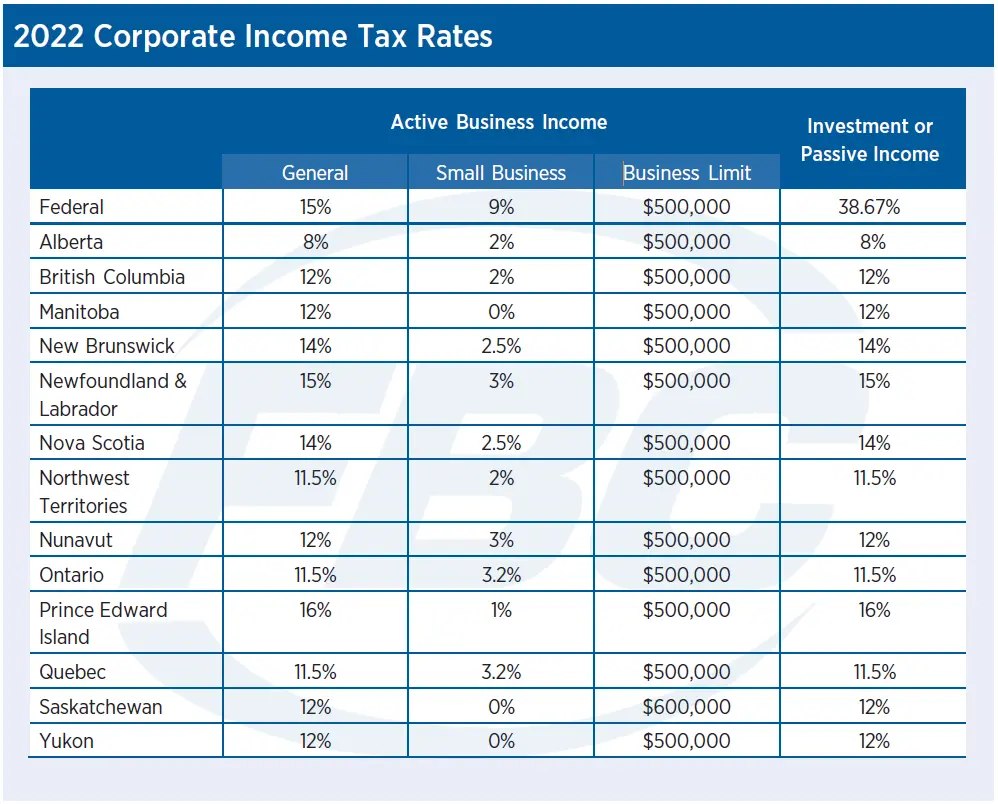

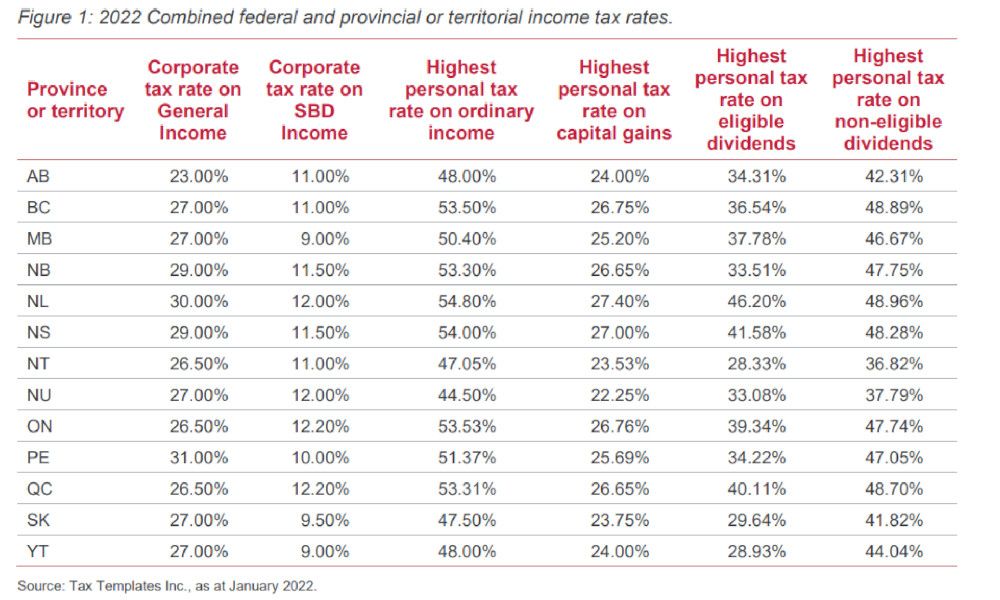

2022 tax rates, brackets, credits | combined federal/provincial tax brackets | Manulife Investment Management

How do you get from Net Income for Tax Purposes to Taxable Income to Tax Payable? – Intermediate Canadian Tax